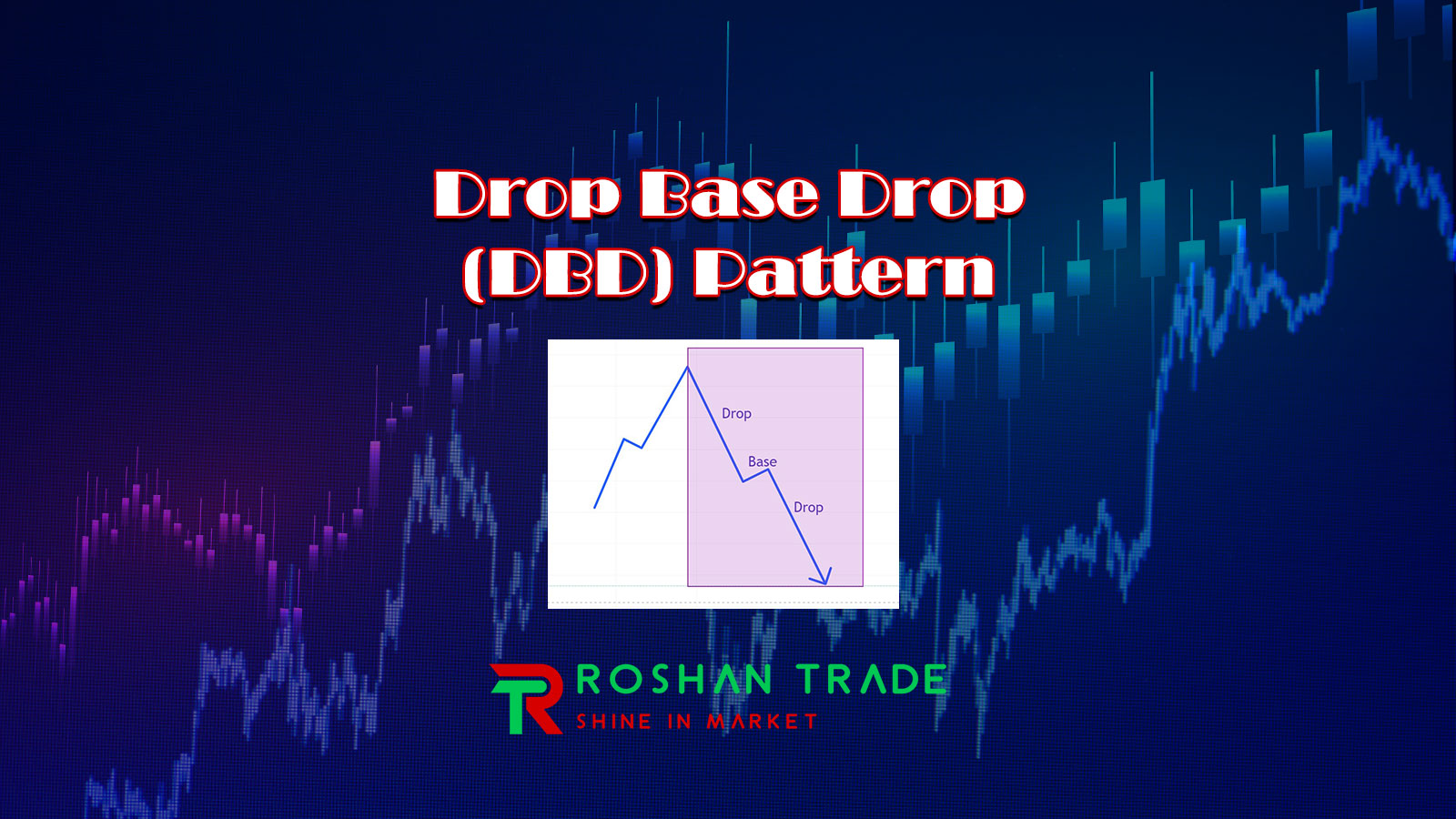

The Drop Base Drop (DBD) pattern is one of the most important patterns in the financial markets that you should not easily ignore. This pattern is one of the most powerful patterns on the price chart that is often ignored and because of this, many people make losses that could have easily been prevented. The DBD pattern is applicable in all financial markets in the world and you can use it to benefit and profit from price movements. This pattern can help you more for entry and allows you to have good entries to maximize your profits.

If you also think that you are one of those people who have problems with your entries and cannot take your profit from a maximum of one move, stay with us until the end of this article to learn more about the DBD pattern and see how to set up a good strategy with the help of DBD.

Reading Suggestion: RBD Pattern

What is Drop Base Drop(DBD) Pattern?

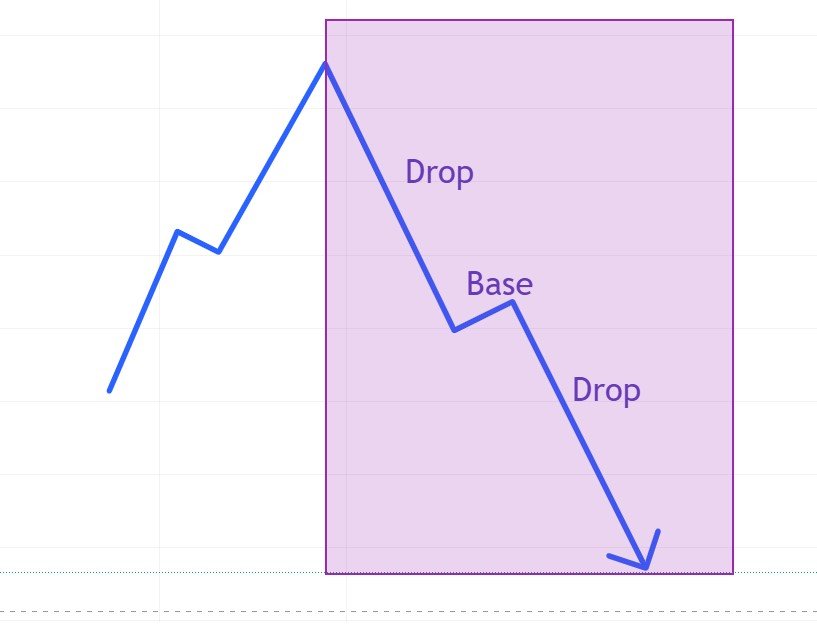

DBD is one of the patterns that you can use to understand the continuation of a downtrend. This pattern tells us the formation of the continuation of the downtrend and has three stages. The first stage is the first drop when the price experiences a sharp downward movement and creates a dominant downtrend. In the second stage, after the initial drop, the price enters a brief consolidation phase and forms a small base where buyers try to push the price higher. And finally, the second price drop, instead of reversing, the price breaks below the base and resumes the downward trend by moving again. This pattern is exactly the opposite of the Rally Base Rally (RBR) pattern, which indicates the continuation of the upward trend.

The DBD pattern is known and used by many traders, and those who describe it on some forum sites say that the reason for its popularity and value is because it confirms the downtrend and works on different time frames.

This pattern shows that sellers are still in control and the downtrend is likely to continue, and it does this not only on the daily time frame, but also on the 5-minute or hourly time frame, and a break below the base provides a short entry with a high probability. The DBD pattern also minimizes fake-outs. Unlike random breakdowns, this pattern has a clear structure and reduces the risk of fake-outs.

Now that you are familiar with this pattern, let’s look at how to identify it on a chart.

How to Spot the DBD Pattern in Price Charts?

Okay, now to be able to make a good strategy out of this pattern we need to identify it. To be able to identify the DBD pattern you need to follow the tutorial below step by step to reduce the percentage of error.

- Step 1: Identify a strong downtrend

- The DBD pattern only works in a confirmed downtrend. Look for lower and lower highs before the pattern forms.

- Step 2: Watch for the first drop

- A sharp decline marks the first phase of the pattern. This drop should be significant enough to create significant selling pressure.

- Step 3: Watch for the base formation

- After the initial decline, the price consolidates and forms a small base (compact range or minor retracement). This base can be:

- Flag (small upward retracement)

- Flag (symmetrical triangle)

- Rectangle (horizontal consolidation)

- Tip: The key is that the base should not exceed the 50% Fibonacci retracement level of the initial decline.

- After the initial decline, the price consolidates and forms a small base (compact range or minor retracement). This base can be:

- Step 4: Wait for the second drop

- This pattern is completed when the price breaks below the base on strong volume, confirming the continuation of the downtrend.

Best Trading Strategy for the DBD Pattern

After identifying the Drop Base Drop pattern, it’s time for the part you’ve been waiting for since the beginning of the article: building a good and effective market strategy using the DBD pattern. To use this pattern, you need to do the following:

First, there’s the entry point. The best entry point is when the price drops below the base support level. To increase confirmation, look for increased trading volume on breakouts, bearish candlestick patterns (e.g., a bearish Marubozu) or when the RSI or MACD show weakness (e.g., RSI below 50, MACD crossing down).

To manage risk, place your stop loss above the recent swing at the base. This ensures that you’ll be exited if the price unexpectedly reverses. To set your take profit, you can also measure the height of the initial drop and project it down from the breakout point. For example, if the initial drop was $10, expect at least a $10 move after the breakout. Alternatively, use Fibonacci extensions (e.g., 1.618 times the initial drop) or support levels from previous price action.

Some Tips that can be Helpful When Trading DBD

- DBD only works in a downtrend. It should not be done in sideways or bullish markets.

- Not every DBD will extend as far as the initial decline. Use different methods and be creative.

- Instead of forcing it on small time frames, wait for high probability.

- To protect your capital, risk only 1-2% per trade.

- Avoid trading DBD in choppy markets – it works best in strong trending conditions.

- Combine with other indicators (e.g., moving averages, trendlines) for further confirmation.

Conclusion

The DBD pattern is used to identify a downtrend continuation. The pattern itself is a high probability downtrend continuation setup that can significantly improve your trading performance. By learning to identify the structure, confirm it with volume and indicators, and apply careful risk management, you can confidently take advantage of long downtrends. Remember that the best entry is a breakdown below a strong volume base. Use measured moves, Fibonacci extensions, or support levels for profit targets, and always set a stop loss and avoid trading DBD in choppy markets.

Was this guide helpful to you? Share it with other traders. For more advanced trading strategies, check out our other in-depth market analysis articles! 🚀