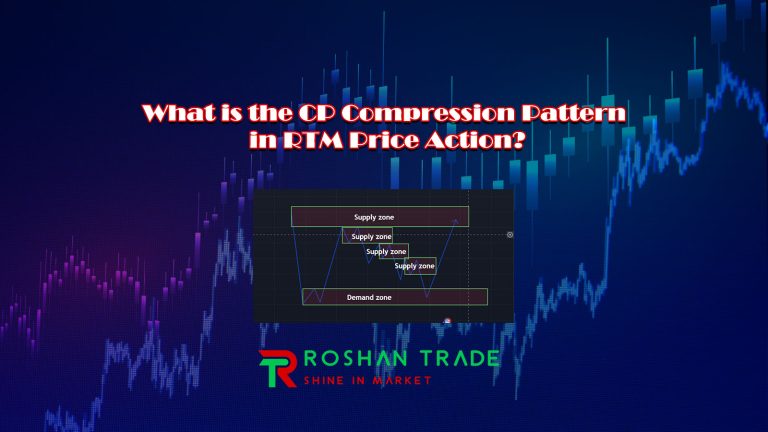

What is the CP Compression Pattern in RTM Price Action?

The CP (Compression) pattern in RTM (Read The Market) price action is a trend-reversal pattern, indicating that the market trend is likely to reverse in the near future. If you observe the CP pattern closely, you’ll notice that it resembles a parabolic wedge pattern. The CP pattern is one of…