Choosing the best trading style is one of the most important decisions you’ll make as a trader. Your trading style will determine how often you trade, the time you dedicate to the markets, and the strategies you use. However, there’s no one-size-fits-all answer to what the best trading style is—it depends on your personality, goals, and resources. In this article, we’ll explore the most popular trading styles, their pros and cons, and how to choose the one that’s right for you.

What is a Trading Style?

A trading style refers to the approach a trader takes to buying and selling assets in the financial markets. It’s influenced by factors like the trader’s time horizon, risk tolerance, and preferred market instruments. Some traders prefer quick, short-term trades, while others focus on long-term investments.

Reading Suggestion: Where to Start Trading

Why is Choosing the Right Trading Style Important?

- Aligns with Your Personality: Your trading style should match your personality, whether you’re patient and analytical or quick and decisive.

- Fits Your Schedule: Some trading styles require constant monitoring, while others are more hands-off.

- Maximizes Profit Potential: Different trading styles suit different market conditions, so choosing the right one can help you maximize profits.

- Minimizes Stress: Trading in a style that doesn’t suit you can lead to stress and poor decision-making.

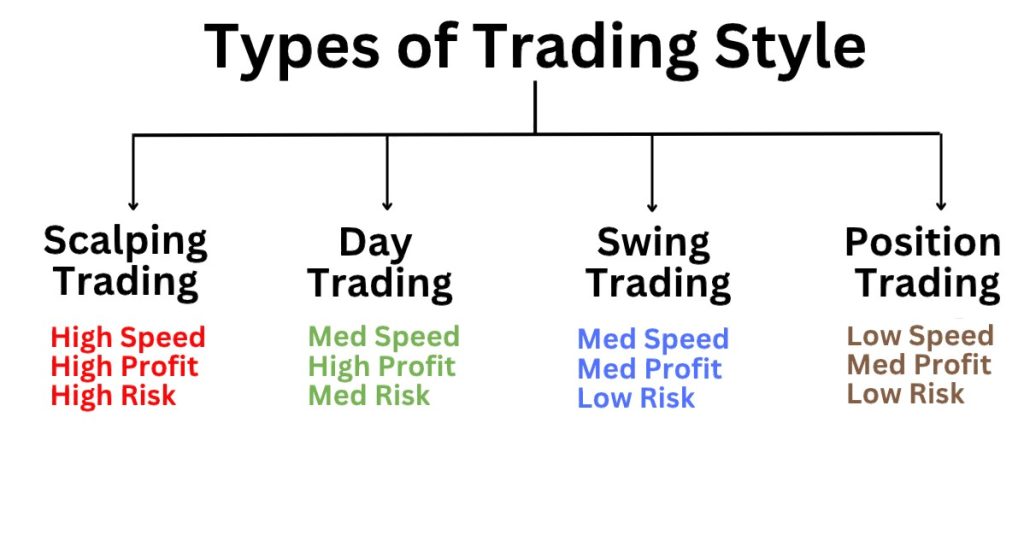

The Most Popular Trading Styles

Here are the most popular trading styles, along with their pros and cons:

1. Scalping

Scalping is one of the most popular trading styles. The strength of this style is the large number of trades in a short period of time. By short-term trades, we mean trades that last for a few minutes. In the scalping style, you are less exposed to the risks of the overnight market.

Of course, all these points were the positive points of scalping, but there are also negative points. In scalping, you need constant attention and quick decision-making, and due to the high number of trades, you have to pay a lot of transaction costs. Scalping is one of the best styles for traders who can devote full-time hours and handle a lot of stress.

2. Day Trading

Trading in general is stressful, and day trading takes it to the next level. In this style, you never see the night markets, and you open and close your trades during the day, taking your profits from the fluctuations that occur throughout the day.

You should also note that day trading requires a lot of time and attention, and you may find it very frustrating at first. This style is suitable for those who can sit in front of the chart all the time and monitor the market.

3. Swing Trading

It can be said that swing traders are like lions lurking for prey and can stay in one trade for weeks. These traders who want to capture the movements in the market price and make relatively large profits compared to other traders. Of course, you should also know that relatively large capital is required for such trades. Less time is required to sit at the chart than day trading or scalping and you can capture larger price movements than day trading.

In this style, you must become someone who can have a lot of patience and discipline. Within a few hours, you analyze the markets for the coming week and wait during the week for your trades to reach your stop loss or take profit. Another danger that threatens you in this style is the weekend or end of the month markets, as well as the night markets in which you have open trades.

4. Position Trading

The position trading style is another popular trading style in which the trader must be very patient because a trade may take weeks, months or even years to yield the desired profit. This style requires a lot of time and effort compared to short-term styles and not everyone can handle it. Since there are few trades in this style, you pay a small trading fee.

In the long run, you are exposed to a lot of risk because the market moves a lot in the long run and may affect you a lot. We recommend that traders with small capital should not work with this style at all.

5. Algorithmic Trading

And the last trading style that you can use is algorithmic trading. In this style, trading is done based on predetermined criteria through computer programs. There are several positive points in this style. In the algorithmic style, decisions are not based on emotions and you can make trades faster than manual trading, but you need a lot of skills that are not just for a trader! You need programming skills or access to pre-built algorithms, which can be expensive to develop and maintain.

How to Choose the Best Trading Style for You

- Assess Your Personality: Are you patient or impulsive? Do you enjoy analyzing data or making quick decisions? Your personality will influence which trading style suits you best.

- Consider Your Schedule: How much time can you dedicate to trading? If you have a full-time job, swing trading or position trading may be more suitable than day trading or scalping.

- Evaluate Your Risk Tolerance: Some trading styles, like scalping and day trading, involve higher risk and stress. If you prefer lower risk, consider swing trading or position trading.

- Start Small: Experiment with different trading styles using a demo account or small amounts of capital to see which one feels most comfortable.

- Educate Yourself: Learn the ins and outs of each trading style before committing. Read books, take courses, and follow experienced traders in your chosen style.

Common Mistakes When Choosing a Trading Style

- Copying Others: Just because a trading style works for someone else doesn’t mean it will work for you. Focus on what aligns with your personality and goals.

- Overcomplicating: Beginners often try to master multiple trading styles at once. Start with one style and stick to it until you gain confidence.

- Ignoring Risk: Some trading styles involve higher risk than others. Make sure you understand the risks before committing.

- Lack of Patience: Switching trading styles too quickly can lead to losses. Give yourself time to learn and adapt.

FAQs About Trading Styles

1. What is the easiest trading style for beginners?

Swing trading is often considered the easiest trading style for beginners because it requires less time and effort than day trading or scalping.

2. Can I switch trading styles?

Yes, many traders switch styles as they gain experience or their circumstances change. However, it’s best to master one style before experimenting with others.

3. Which trading style is the most profitable?

No trading style is inherently more profitable than others. Profitability depends on your skill, strategy, and market conditions.

4. Do I need a lot of capital to start trading?

The amount of capital you need depends on your trading style. Scalping and day trading may require more capital due to frequent trading, while swing trading and position trading can be started with smaller amounts.

5. How do I manage risk in trading?

Risk management is crucial in any trading style. Use stop-loss orders, diversify your portfolio, and never risk more than you can afford to lose.

By understanding the most popular trading styles and assessing your personality, schedule, and risk tolerance, you can choose the best trading style for your needs. Remember, there’s no “best” style for everyone—the key is to find the one that works best for you. Happy trading!