The world of trading is advancing day by day, and if you’ve been in this world for a while, you’re probably familiar with the Flag Pattern. The Flag Pattern is a powerful continuation pattern that signals a pause in a strong trend before the price continues in the same direction. But have you ever heard of the Inner Flag? A lesser-known pattern that is like a hidden gem within the Flag. In the RTM (Read The Market) style, this pattern is one of the best tools to help traders determine more precise entry points and better risk management. So, learning this pattern is essential for you if you’re new to trading.

In this article, we’ll explore the concept of the Inner Flag, how to recognize it, and how to use it effectively. By the end, you’ll be able to develop a better strategy for entering trades and have a clear understanding of this pattern. You’ll also be able to apply it in Forex, Crypto, Stocks, or any other market you trade. So, let’s get started!

Reading Suggestion: Origin in RTM

What is the Inner Flag?

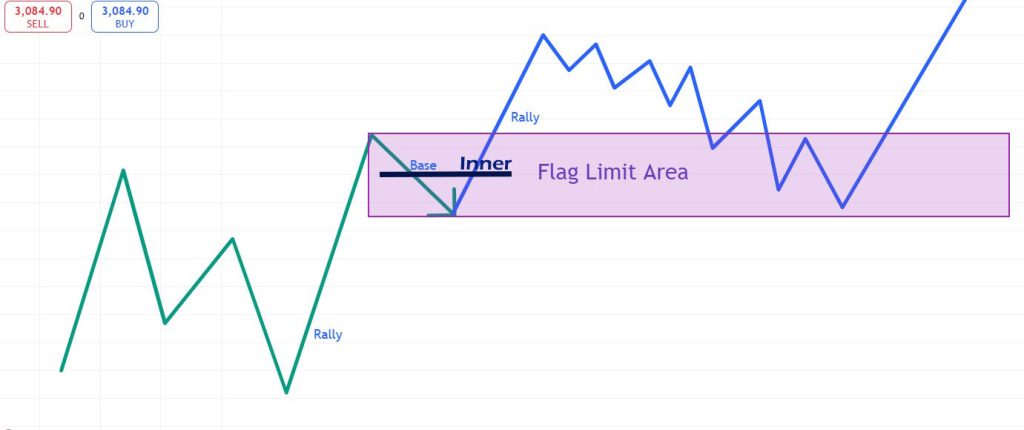

The first question that comes to mind when you hear the name of this pattern is: What exactly is this pattern that many people haven’t even heard of? The Inner Flag is a smaller version of the traditional Flag Pattern. It occurs within a larger flag, and as the name suggests, it’s the inner part of a flag, providing traders with an early entry point. This pattern allows you to catch the continuation of the previous trend.

In the RTM style, the Inner Flag can be extremely useful if you know how to use it properly. It enables you to enter trades earlier with tighter stop-loss levels, maximizing your risk-to-reward ratio. The only things you need are a keen eye for price action and a deep understanding of market structure.

You might be wondering, Why is the Inner Flag important?

- There are several reasons why the Inner Flag is important. The first reason is early entry. The Inner Flag allows you to enter a trade sooner than waiting for the main flag breakout, increasing your profit potential.

- Since the Inner Flag is very small, you can also set a tighter stop-loss, which reduces your risk exposure.

- Additionally, the Inner Flag acts as a confirmation of the main flag, increasing the probability of a successful trade.

How to Recognize the Inner Flag in RTM?

Now that you’re familiar with the Inner Flag, what it does, and what it can achieve, you’re probably eager to learn how to identify and use it. In the RTM (Read The Market) style, the focus is on price action and market structure, so we’ll concentrate on these aspects.

Step 1: Identify the Main Flag

The first step in recognizing the Inner Flag is to identify the main flag. The main flag should resemble a rectangle or a small channel, where the price oscillates between support and resistance levels. The main flag is a larger consolidation that forms after a strong price movement. There are two types of flags:

- Bullish Flag: In an uptrend, the main flag will have a slight downward or sideways price movement.

- Bearish Flag: In a downtrend, the main flag will have a slight upward or sideways price movement.

Step 2: Look for the Inner Flag

To correctly identify the Inner Flag, you’ll need practice and repetition. Once you’ve identified the main flag, look for the Inner Flag. The Inner Flag is a smaller consolidation that forms within the main flag. It should also resemble a rectangle or a small channel, but it will be much tighter and shorter in duration.

To better understand this, we can divide the Inner Flag into two types:

- Bullish Inner Flag: In a bullish main flag, the Inner Flag will have a slight downward or sideways movement within the main flag.

- Bearish Inner Flag: In a bearish main flag, the Inner Flag will have a slight upward or sideways movement within the main flag.

Step 3: Confirm the Breakout of the Inner Flag

The final step in identifying the Inner Flag is to confirm the breakout. A breakout occurs when the price breaks out of the Inner Flag’s boundaries and continues in the direction of the initial trend.

- Bullish Inner Flag Breakout: The price breaks above the Inner Flag’s resistance level, signaling the continuation of the initial uptrend.

- Bearish Inner Flag Breakout: The price breaks below the Inner Flag’s support level, signaling the continuation of the initial downtrend.

The breakout should be strong and decisive, with high volume (if available) confirming the move. This is the entry point for traders looking to capitalize on the Inner Flag.

Common Mistakes When Trading the Inner Flag

Here are some common mistakes traders make when trading based on the Inner Flag. By following these simple and key tips, you can reduce your risk and plan your trades in a way that maximizes your profits.

1. Ignoring the Main Flag

The Inner Flag is only effective when it occurs within a main flag. If you try to trade an Inner Flag without a clear main flag, the pattern is likely to fail.

2. Trading Without Confirmation

Entering a trade before the breakout is confirmed is a recipe for disaster. Always wait for the price to break out of the Inner Flag’s boundaries before entering a trade.

3. Neglecting Risk Management

Even if you know the best strategies and patterns, without proper capital management and risk management, you won’t be able to achieve significant profits, and in most cases, you’ll end up with negative returns.

Conclusion

The Inner Flag is one of the most powerful and useful tools for day trading, but you need to know where it forms and how to use it. This pattern provides traders with entry points and stop-loss levels that make higher profits with lower risk possible.

Remember, the key to success in trading is patience, discipline, and continuous learning. Take the time to practice identifying and trading the Inner Flag on different timeframes and markets. Over time, you’ll develop the intuition and confidence needed to spot Inner Flags and capitalize on them.

So, the next time you see a main flag forming, keep an eye out for the Inner Flag. It could be your ticket to a profitable trade! (But if you’re not careful, it could also be a trap to catch you!)

If you found this article helpful, share it with other traders or leave your comments below. If you have any questions about Inner Flag trading or RTM, don’t hesitate to ask—we’re here to help you succeed in the markets!