You see trends and indicators, but there’s something missing—the missing piece is Origin. Even if you know all the technical aspects, you might make profits most of the time, but if you don’t know where the movement originates, you could suffer avoidable losses. This article will help you prevent those mistakes.

In RTM (Read The Market), Origin is the starting point of a price movement—where the big traders (smart money) enter the market. By understanding Origin, you can achieve:

✅ High-probability trade entries

✅ Avoiding market maker traps

✅ Trading WITH the “big players” instead of against them

Now, you might wonder: If this is so powerful, why don’t most people use it? Many traders want to apply this method, but the problem is:

Most traders don’t know how to correctly identify Origin. They chase price action without understanding where the real move begins.

But don’t worry—by the end of this article, you’ll separate yourself from those traders and fully understand how to trade with Origin.

Here’s what you’ll learn:

🔹 What Origin REALLY is (and what it’s NOT)

🔹 How to spot Origin on any timeframe

🔹 The 3-step process to confirm Origin

🔹 Common trader mistakes (and how to avoid them)

So, stay with us.

Reading Suggestion: Swap Pattern in RTM Price Action

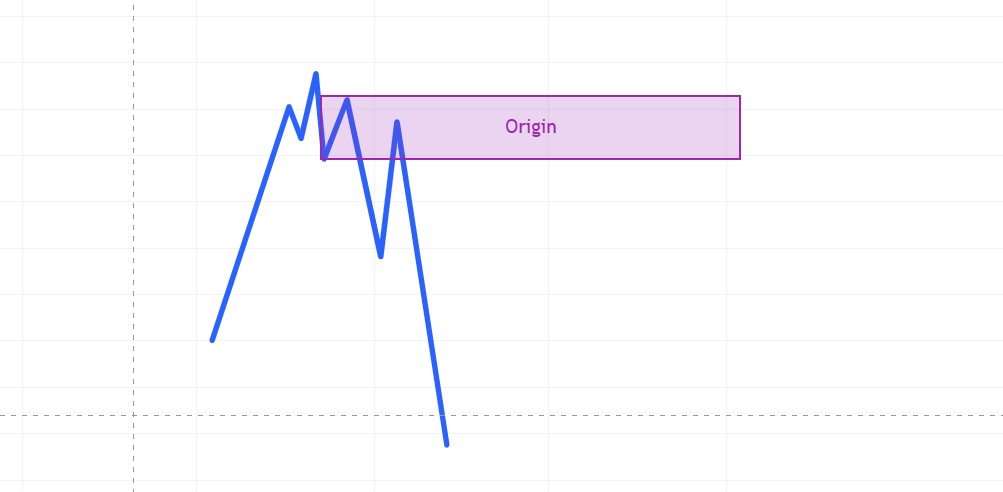

1. What is Origin in RTM?

Let’s first understand the concept of Origin—what does it really mean?

Origin is NOT just a random swing high or low. It’s a critical level where market makers or smart money initiate a major move. You can think of it as a hidden starting point—if identified correctly, it can lead to significant profits.

Here’s how to look at it:

Retail traders react to price movements.

Smart money creates them—and leaves clues at Origin points.

Key Characteristics of Origin:

✔ Strong liquidity zone (where large orders are filled)

✔ Price rejection or absorption (sudden reversal or consolidation)

✔ Volume spike (confirms institutional activity)

Origin can be a powerful launchpad for your trades—if you pay attention.

Example: If price suddenly reverses after hitting a key level with high volume, that’s likely an Origin point.

2. How to Spot Origin on the Chart (3-Step Method)

Step 1: Find Key Liquidity Zones

Origin forms near:

- Previous highs/lows (where stops are clustered)

- Major support/resistance levels

- Fair Value Gaps (FVGs) or Order Blocks

Pro Tip: Use volume profile to see where the most trading activity occurred—this helps identify where smart money is placing trades.

Step 2: Watch for Price Rejection or Pullback

- Rejection: Price sharply reverses (strong bearish/bullish wick)

- Absorption: Price stalls, then breaks out (slow accumulation)

Example: If price hits resistance, gets rejected with a long wick, and drops—that’s an Origin for a bearish move.

Step 3: Confirm with Volume & Market Structure Shift

- Volume MUST spike at the Origin point.

- Market structure must break (e.g., a higher high gets invalidated).

3. Use Origin like a Pro (entry point, stop loss and TP)

If you want to trade Origin, you need to consider a few things and enter the trade according to them. The most basic thing you need to pay attention to is not to enter the trade without confirmation. First, you need to wait for a breakdown of the structure and keep an eye on the trading volumes. Then, if the price returns to Origin and reverses again, enter on the retest.

Consider placing your stop loss above Origin for shorts (if bearish) and below Origin for longs (if bullish). Place your take profit limit at the first target closest to the liquidity pool. Place the second target at the next major swing level.

Example trade: Price rejects key resistance (Origin forms) and the market structure breaks (low-low confirmed). Enter short on the retest, avoid losing above Origin. Take profit at the next support.

4.Common Mistakes When Trading Origins That You Should Avoid!

❌ Mistake 1: Trading Every Rejection as an Origin (That’s Right, It Should Be Confirmed by Volume).

❌ Mistake 2: Ignoring Market Structure (Origin Should Be in Line with the Trend).

❌ Mistake 3: Placing Stops Too Tightly (Smart Money Hunts for Weak Stops).

Always ask yourself before entering a trade: “Is this where the institutions are entering?” If not, then it’s not Origin.

5.Practical Exercise: Find Origins on Charts

Your Assignment:

Open a 5-minute or 1-hour chart (any market).

Mark key areas of liquidity (swing highs/lows).

Look for rejections + volume increases.

Practice identifying Origins before placing trades.

Remember: The more you practice, the faster you will be able to tell the real original from the fake.

Conclusion

Conclusion: Master Origin, Master RTM

Origin is the foundation of RTM trading. If you can identify it, you will see how much better it is to trade with institutions than against them. Also, you will avoid emotional reactions and follow big moves before retail traders.

Now it is your turn to open your charts, find at least 3 origin points and see how the price reacted after them.

Question for you:

Have you already noticed Origin but don’t know what it is? Share your experience in the comments!

“The market does not move randomly – it moves from Origin. Learn to see it and you will profit.”