When you first encounter the chart, you may feel like you know nothing about this vast ocean and that you’ll never be able to stand tall among these giants. But that’s not the case. You can easily navigate this field, like a piece of cake, by using the right tools and methods.

One such method, which many in the market currently favor, is RTM (Reading the Market). This style involves precise analysis that greatly helps traders profit from financial markets. The RTM style also has its own specialized tools, which can be useful for beginners at the start.

Additionally, there are several tools, such as certain indicators, that you’ll become familiar with if you stay with us until the end of this article. By understanding the purpose of each, you’ll be able to use them like a pro.

Reading Suggestion: How to Avoid Overtrading and Stay Disciplined in Forex?

What is RTM?

Before diving deeper into the tools, it’s better to discuss RTM a bit more so you can better understand what you’re about to learn.

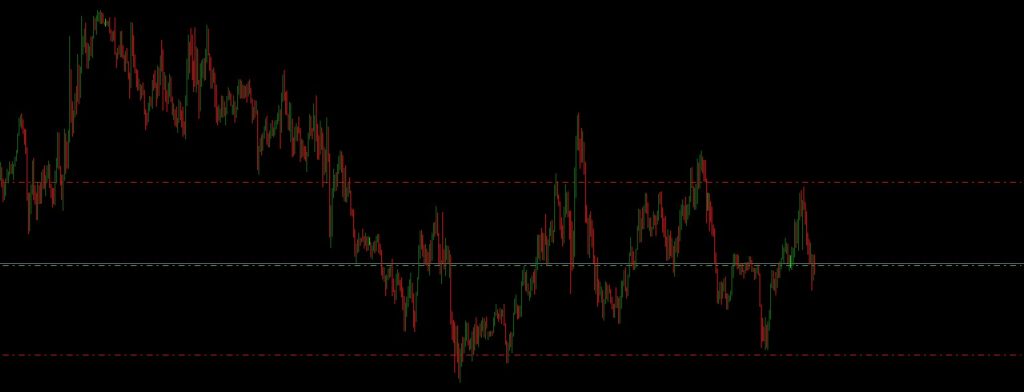

RTM is based on the principle that prices oscillate around an average or mean value, and over time, they tend to revert to this mean. This strategy relies on statistical analysis and involves identifying overextended price movements, allowing traders to profit from potential price corrections.

Now, let’s move on to the tools.

1.Charting Software

One of the best tools every trader—especially those using RTM strategies—needs is charting software. This software enables you to visualize price movements over time, helping you identify trends, historical averages, and fakeouts.

| Feature | Description |

|---|---|

| Interactive Charts | Allows users to analyze price movements through various chart types (line, bar, candlestick). |

| Technical Indicators | Tools like moving averages, Bollinger Bands, and RSI for assessing price trends. |

| Customization | Personalize settings, colors, and timeframe for a better trading experience. |

2.Market Strength Indicators

Another essential tool in RTM is indicators that show where the market’s strength lies. Typically, the market tends to move more strongly in the direction where there’s high trading volume and where smart money is flowing. Thanks to their complex algorithms, these indicators are extremely useful, even for beginners.

| Indicator | Purpose |

|---|---|

| Moving Averages | Smooths out price data to identify trends over a specified period. |

| Bollinger Bands | Help determine volatility and potential price reversals, set above and below a moving average. |

| Relative Strength Index (RSI) | Measures the speed and change of price movements to identify overbought or oversold conditions. |

3.Backtesting Software

Once you’ve chosen a strategy—whether you’re a day trader or an investor—the first thing you should do is backtest it. Backtesting software allows traders to apply their strategies to historical data to evaluate performance before risking real capital. If your strategy works in backtesting, you’ll naturally have more confidence in your trading style.

| Feature | Benefits |

|---|---|

| Historical Data Access | Evaluate how an RTM strategy would have performed in past market conditions. |

| Simulation | Test different parameters and strategies to optimize results. |

| Performance Metrics | Analyze drawdowns, win rates, and overall profitability of the strategy. |

4.Economic Calendar

If you want to become a successful trader, you must stay informed about global events that impact the currencies you trade. For this, you need a special calendar—an economic calendar. This calendar highlights key economic indicators, news releases, and events that influence market movements. For RTM traders, being aware of upcoming economic events is crucial, as they can trigger significant price volatility—something you often can’t predict through technical analysis alone.

| Event Type | Importance |

|---|---|

| Economic Indicators | Data releases like GDP, employment figures, or inflation rates that may influence asset prices. |

| Central Bank Meetings | Announcements on interest rate changes that can lead to price volatility. |

| Major News Events | Global events that could impact market sentiment and potentially cause a return to mean price actions. |

5.Risk Management Tools

No trading strategy is complete without strong risk management tools. Effective risk management helps protect your trading capital, especially when price movements become unpredictable and test your mental resilience. Even during high market volatility, always use a stop-loss—because if the price moves against your analysis, you should only lose an amount you can recover in future trades.

| Tool | Purpose |

|---|---|

| Position Sizing | Determine the size of each trade based on risk tolerance and account balance. |

| Stop-Loss Orders | Automatically exits a position when a specified loss is incurred, limiting potential losses. |

| Take-Profit Orders | Locks in profits by automatically selling a position when it reaches a specified profit level. |

6.Trading Journal

A trading journal is a personal log where traders record their trades, emotions, and outcomes. If you lose repeatedly due to a specific mistake, tracking it helps you avoid repeating it. Conversely, if you’re profiting without realizing why, documenting your process helps you unlock the secret to your success. Additionally, when a trade goes wrong, reviewing your journal lets you identify flaws in your analysis and improve over time.

By combining RTM strategies with these essential tools, you’ll build a disciplined, data-driven approach to trading—maximizing your chances of long-term success.

| Feature | Benefits |

|---|---|

| Trade Documentation | Record entry and exit points, position sizes, and outcomes for each trade. |

| Emotional Tracking | Note emotional responses to trades, helping to identify psychological patterns influencing decisions. |

| Performance Review | Regular reviews of trades can highlight strengths and weaknesses, leading to improved performance. |

Conclusion

For beginners entering the world of trading, RTM might seem complex at first—but with the right tools, you can significantly improve your ability to navigate financial markets effectively.

By using proper charting software, technical indicators, backtesting tools, and a disciplined risk management strategy, you can already picture yourself on the path to success.

In trading, patience and continuous learning are the foundations you should never overlook. Remember, every experienced trader was once a beginner. Embrace the learning process, and you might find yourself mastering RTM trading tools sooner than you think!