If you are an experienced market participant, you have likely faced challenges with entry and exit points in your trades. There are numerous difficulties when it comes to price analysis and identifying entry and exit points, which not everyone can overcome. In this context, price patterns act as a guiding tool for traders, helping them make crucial decisions. One of the practical and intriguing patterns in the RTM (Read The Market) style is the Trigger Man pattern. This pattern is not only useful in international financial markets like Forex and Crypto, but it can also be applied in stock trading to define your entry and exit points.

In this article, we will delve deeper into the Trigger Man pattern, and you will learn how to identify and use it. Additionally, we will share key insights about this practical pattern that have never been discussed before! If you want to improve your performance in the financial markets, stay with us until the end of this article.

Reading Suggestion: Can Can Pattern in RTM

What is the Trigger Man Pattern and Where is it Applied?

First, let’s explore what the Trigger Man pattern is and its applications. The Trigger Man pattern is one of the most widely used patterns in the RTM style, helping traders identify entry and exit points.

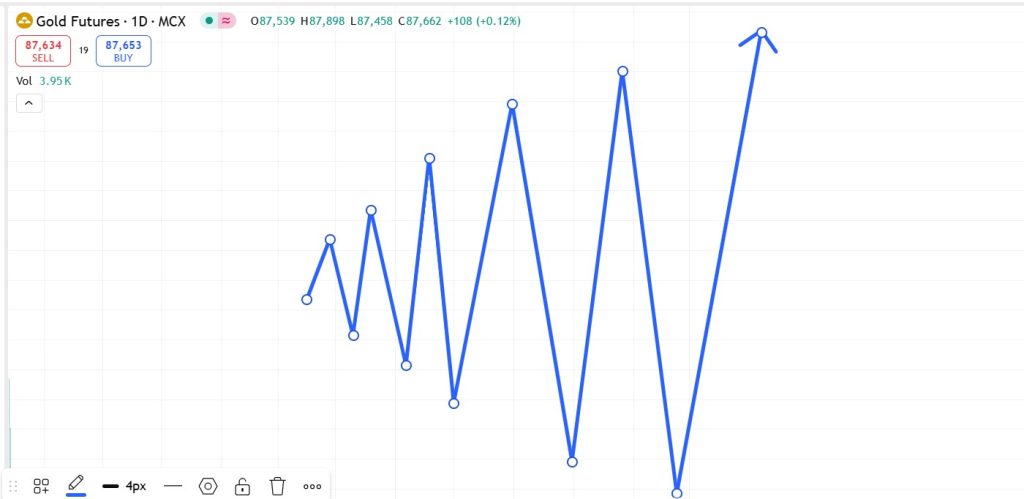

While there are many ways to determine entry and exit points, this pattern identifies these points with high precision. The pattern forms when the market is strongly trending in one direction, and traders are looking for an opportunity to enter a trade.

You might be wondering, what is the core concept of the Trigger Man pattern? This pattern is based on price action and the market’s reaction to key levels. When the price approaches a significant support or resistance level, traders wait for a trigger or catalyst. This trigger could be a strong breakout, a pullback, or a sharp move indicating the continuation of the trend.

The Concept of Trigger Man

Trigger Man translates to “trigger puller.” As the name suggests, this pattern helps traders make better decisions at critical moments in the market, ensuring they don’t miss out on trading opportunities.

Key Components of the Trigger Man Pattern

- Key Level: This is the point where the price reacts. It could be a support, resistance, or a psychological level.

- Price Action: Another crucial component of the Trigger Man pattern is price action, which should indicate the strength or weakness of the market.

- Entry Signal: This signal indicates the right time to enter a trade and can manifest as specific candlesticks, a breakout (BOS), or other price patterns.

How to Identify the Trigger Man Pattern

Now that you understand the concept of the Trigger Man pattern, you’re probably eager to learn how to identify it in the market.

- Identify the Key Level: The first step in identifying the Trigger Man pattern is to locate the key level. This is a strong support or resistance level where the price has reacted in the past, either recently or in the distant past. For example, if the price has hit a resistance level multiple times and then declined, this level can be considered a key level.

- Analyze Price Action: After identifying the key level, you need to analyze the price action around this level. Does the price approach this level and then reverse? Or does it break through and continue its movement? This analysis helps you determine the strength or weakness of the market.

- Detect the Entry Signal: Now that we’ve understood price action analysis and how to gauge the market’s strength, the next step is to detect the entry signal. When the price approaches the key level, you should look for an entry signal. This signal could appear as specific candlesticks like a Pin Bar, Engulfing Candle, or a breakout. These signals indicate that the market is ready for a trend reversal or continuation.

- Confirm the Detected Signal: In the strategy you design for yourself, besides selecting a pattern, you should also have a confirmation signal for entering a trade. This confirmation could be in the form of price movement in the expected direction or the use of other indicators like RSI or MACD. Confirming the signal helps ensure its accuracy.

To better understand this concept, let’s look at the following example.

Let’s assume that in the Forex market, the EUR/USD currency pair is approaching a strong resistance level. This level has acted as resistance multiple times in the past, and the price has declined after touching it.

- Identify the Key Level: The resistance level at 1.2000 is identified as the key level.

- Analyze Price Action: The price approaches the 1.2000 level and then forms a Pin Bar candlestick, indicating weakness among buyers.

- Detect the Entry Signal: The Pin Bar is considered as the entry signal.

- Confirm the Signal: After the formation of the Pin Bar, the price starts to decline and falls below the resistance level. This movement confirms the signal.

You can then enter a sell trade.

Final Thoughts

If you also want to trade using the RTM (Read The Market) style, you must at least familiarize yourself with the important patterns of this approach. The Trigger Man is one of the most fundamental patterns used to determine entry and exit points. This pattern is based on market behavior and price movements, providing traders with signals that indicate either a trend reversal or continuation.

To use this pattern, you need to identify the key level, analyze the price action, detect the entry signal, and confirm it. With patience, discipline, and risk management, you can use this pattern as a powerful tool in your trading. Patience is the key factor in the success of any strategy, so when using the Trigger Man pattern, remember to be patient, practice consistently, and never give up on debugging.

We hope this article has been helpful, and that you’ve gained a good understanding of the Trigger Man pattern, as well as how to identify and use it effectively. If you have any questions, feel free to ask in the comments, and our admins will respond to you.