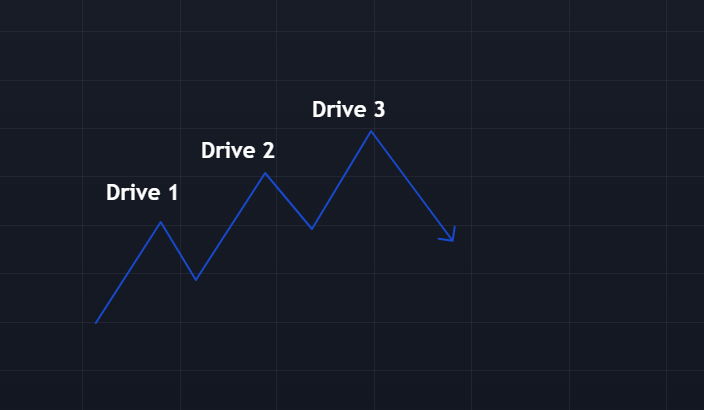

The Three-Drive Pattern is one of the price patterns in technical analysis and price action, used to identify trend reversals in Forex. This pattern is based on the well-known Fibonacci ratios and completes with 127% or 161.8% (618%) extensions.

This pattern consists of three impulse waves, where the price typically reaches a significant level, indicating that the market is exhausted from its current movement. As a result, upon reaching a new supply or demand zone, the price is expected to reverse.

What is the three-drive pattern in price action?

The 3drive pattern is not a valid pattern and is only used to confirm a trend change. For example, we are in an uptrend and a valid supply zone is in front of us. Now, if the 3drive pattern also appears on the way to the supply zone, we can place a SELL order in the supply zone with more confidence.

The figure below shows the harmonic 3drive pattern in technical analysis and then we have drawn the 3drive pattern in price action.

The purpose of the three-drive pattern

The purpose of the Three Drive pattern is to help identify a trend change in the market. This pattern cannot be used alone and traders use it to confirm a trend change in the market. When you are in a trend (for example, downtrend) and you have already drawn the demand area for the trend.

In this case, by observing the Tree Drive pattern, we can conclude that the sell orders have been filled halfway and the strength of the sellers has decreased. Upon reaching the demand area, the dominance of the buyers over the sellers will increase, and we will see a change from a downward trend to an upward trend.

three Push Pattern in Price Action

In the Three-Drive pattern, if the three triangles form at the end of a trend, it is also referred to as the Three-Push pattern in price action, and its behavior is identical to that of the Three-Drive pattern.

In the Three-Drive pattern, from the start of the price movement until it reaches the demand zone, there must be three triangles in total. These three triangles may form either mid-trend or at the beginning of the trend. However, in the Three-Push pattern, these three triangles form consecutively at the end of the trend—specifically, at the peak (in an uptrend).

How to trade the Trey Drive pattern

To teach how to trade using the Three-Drive pattern, we’ll use an example.

In the chart below, we’ve drawn the supply zone. As we mentioned, the Three-Drive pattern alone is not tradable or a signal—it is used as a confirmation tool. In this example, the price is approaching the supply zone, and along the way, the Three-Drive pattern appears, which we’ve marked.

Therefore, we can place a sell order with greater confidence when the price reaches the demand zone, as the Three-Drive pattern is a sign of a potential trend reversal in the market.

Note that if there is a gap in the Three-Drive pattern, the pattern will not have sufficient validity. In this case, you should examine more factors.

Another critical point to remember is that no pattern can provide a definitive outcome. The emergence of a Three-Drive pattern does not guarantee a reversal. If the pattern fails, the likelihood of a continuation of the trend becomes stronger.

When using this pattern, you must also have a comprehensive strategy. Simply put, no pattern alone can ensure success in the world of financial markets.

How to recognize a harmonic tri-drive pattern

As mentioned throughout the text, this pattern follows its own set of rules. The points below outline some of its most important principles:

1. Strong Impulse Waves (Drive 1)

These waves typically represent sharp price movements (up or down), forming a highly volatile swing leg.

2. Corrective Waves (Drive 2 – Controlling Phase)

These waves indicate price movement against Drive 1. In the Three-Drive pattern, Drive 2 usually retraces at least 61.8% of the Fibonacci level.

3. Final Drive (Drive 3 – Reversal Phase)

This wave signals that the price is returning to the trendline (or the main trend). Typically, Drive 3 retests the pattern’s starting point.

The pattern helps identify entry and exit points:

- Entry points are often set near the reversal zone.

- Exit points are usually placed close to the pattern’s origin.

The importance of the three-drive pattern

As we mentioned, the Three-Drive pattern is one of the most important patterns that can be highly profitable for traders. Many people believe they can find a single “magic” pattern or tool that will suddenly make them rich! However, this is simply not possible – not with the Three-Drive pattern, nor with any other trading pattern.

That said, mastering the Three-Drive pattern and learning how to trade it correctly can significantly improve your decision-making and ultimately lead to greater success in the markets.

A Critical Reminder:

Before making any trading decision, always confirm that you’ve correctly identified the pattern. Unfortunately, we’ve seen countless cases where traders misidentify patterns, leading to costly mistakes and unnecessary losses.

Conclusion

The Three-Drive Pattern is one of the methods used in technical analysis. As we’ve emphasized repeatedly, success in financial markets requires adequate knowledge and experience.

This harmonic pattern, also referred to as the Three-Drive pattern (or simply “Three-Drive”), shares similarities with the I Butterfly pattern. The key difference between them is that the I Butterfly consists of four waves.

The Three-Drive pattern represents one of the valuable technical analysis tools that – when used correctly alongside a comprehensive trading strategy – can lead to substantial profits.